VAT Calculator

This online calculator allows you to easily calculate the total cost of an item or service, including VAT (Value-Added Tax). It uses a VAT inclusive price formula and provides examples of calculations. It helps you to find out the final price of the item or service by adding the VAT rate to the original price.

What is VAT?

VAT, or Value-Added Tax, is a sales tax on the added value of a product or service. It is calculated as a percentage of the final price paid by the consumer and is intended to be a fair way of raising funds for government budgets. However, the way VAT is applied can vary greatly between countries, making it tricky to understand and calculate.

In some countries, VAT is applied at a universal rate, typically between 15-25%, with certain industries or products being excluded from the tax. For example, education, books, basic food, and transportation may be exempt from VAT. However, in other countries, different VAT rates may apply to different sets of products and services. For example, the official VAT rate may be 20%, but books may have a 5% VAT rate and travel and accommodation services may have a 10% VAT rate. This is where a VAT calculator can be helpful in understanding the cost of goods and services.

It is mostly prevalent in Europe and adopted by other countries, although the name may be different. However, the consistency of VAT application varies from country to country. VAT is considered as unfair to people in a poorer economic situation by those who believe in equality of outcome, as it is a tax on consumption.

VAT calculation formula

The VAT-inclusive price formula used in this VAT calculator is simple to use, it’s just a percent increase over the base price (gross amount, the amount excluding VAT). The equation is:

Price with VAT = Base Price x (100% + VAT(%))

For example, to calculate a net amount of €115, including a 15% VAT, when the base price is €100, we need to multiply €100 x (100% + 15%) = €100 x 115% = €115. Mathematically, it can also be calculated as 100 euro x 1.15

The formula to calculate VAT from a gross amount in any currency is:

VAT = Base Price x VAT(%)

For example, if the gross amount is €20 and the tax rate is 10%, the VAT is equal to €20 x 10% = €2. It’s also the same as multiplying 20 by 0.1. The net amount is the sum of the gross amount plus the VAT, so €20 + €2 = €22.

The formula to remove VAT from a net price is:

Gross Amount = Net Amount / (1 + VAT(%))

For example, to remove a 20% VAT from a net price of €120, you divide 120 by 1.2, which equals €100.

VAT calculation examples

Example 1: To calculate the net amount with VAT included, when the price without VAT is €80 and the VAT rate is 20%, use the first equation and substitute the values: €80 x (100% + 20%) = €80 x 120% = €80 x 1.2 = €96.

Example 2: To find out the absolute value of the VAT on a product that costs $50 and the VAT rate is 20%, use the second equation: $50 x 20% = $10.

Example 3: To find out the amount that the merchant or service provider actually pockets, when the net price is €150 and the VAT rate is 20%, use the third equation: €150 / (100% + 20%) = €150 / 120% = €150 / 1.20 = €125. This is the price before VAT was added.

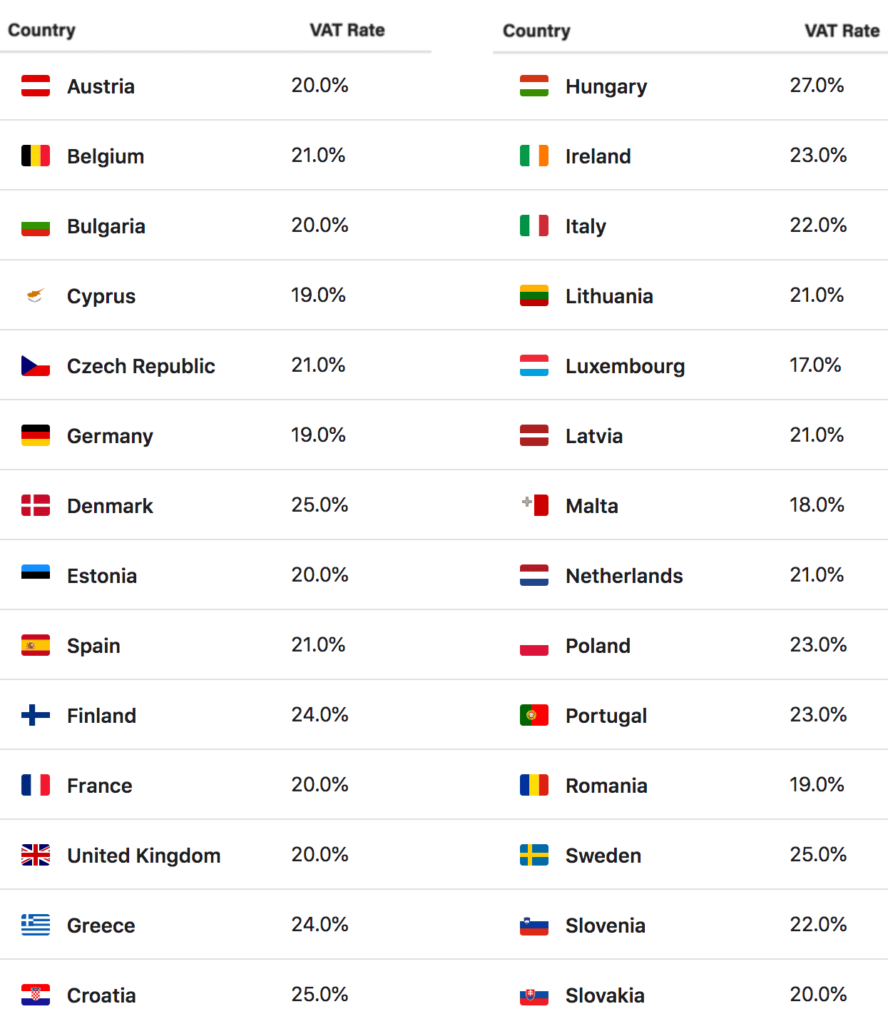

VAT rates in Europe

It can be helpful to have an understanding of the typical VAT rates across Europe. A chart of European countries sorted by their standard VAT rate is provided for reference.

Please note that the data provided is as of Jan 2023 and VAT rates may have changed since then. It is important to verify the applicable tax rate at the time of purchase from an official source. Some countries may also have exceptions for certain goods or services, such as tourism, alcohol, healthcare, and education. Failure to do so may lead to inaccuracies in estimating the tax amount and final price.

Is it a VAT-inclusive price?

When adding VAT to a price, it’s important to first check if the sales tax has already been included. In many countries, merchants and service providers are required to display the VAT-inclusive price on products, whether in-store or online. Some merchants will list the price excluding VAT and the VAT amount separately, while others will only display the VAT-inclusive price. This information may be noted next to the price, in the footer of the page, or in the terms and conditions. If unsure, it’s always best to ask the merchant for the final amount including VAT.

It can be more complex when both the provider and the consumer are VAT-registered entities. In this case, it’s common to exchange price information without VAT included, as the consumer entity will be reimbursed for the VAT tax at the end of the month. However, it’s important to consider the net amount including VAT for larger purchases and cash flow. Our calculator can be helpful in these situations.